Lynchburg, Virginia has two Commonwealth of Virginia Enterprise Zones: #2 and #46. These zones span 4,200 acres of commerical property in Lynchburg. The program is managed by the Virginia Department of Housing & Community Development, with the Lynchburg Office of Economic Development serving as the local zone administrator.

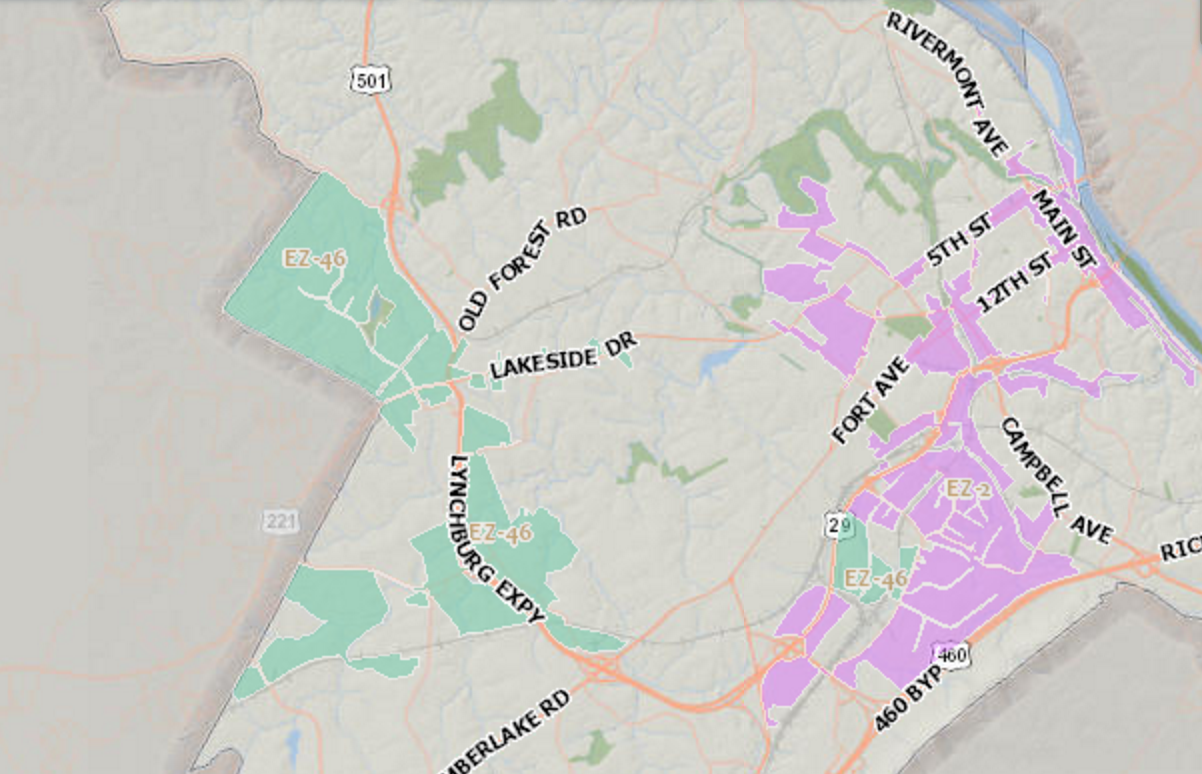

Map of Lynchburg’s Enterprise Zones. See if your business is in an Enterprise Zone using this mapviewer tool: View Map

Businesss in these geographic areas may qualify for certain incentives, including cash grants for real estate investments and job creation grants. Enterprise Zone grants are performance-based, which means the jobs must be created and real property improvements need to be completed before submitting grant applications.

Grant Opportunity #1: Job Creation Grants

Receive up to $800 annually per job created with Enterprise Zone Job Creation Grants

Businesses that have created five or more jobs in Enterprise Zones may be eligible to receive up to $800 in cash per job, per year. These cash grants are awarded for up to five years. Businesses that apply for this grant must pay wages that are equal to, or above, 175% of the Federal minimum wage. Employees must be full-time, in permanent roles, and receive health benefits. Personal service, retail and food and beverage positions are not eligible for cash grants.

Ineligible businesses:

- Units of Government, including local, State or Federal agencies and semi-governmental organizations

- Non-Profits, unless they are Business and Professional Organizations as classified under NAICS 813910 and 813920

Job Creation Awards:

- Up to $500 annually per net new permanent, full-time position earning at least 175% of the Federal Minimum Wage, with offered health benefits that cover at least 50% of the Health Insurance Premium cost

- Up to $800 annually is awarded if the employee is paid 200% of the Federal Minimum wage with health benefits

- Businesses can receive JCGs for up to 350 positions per year

Grant Opportunity #2: Real Property Investment Grants

Receive up to $200,000 for your commercial, industrial or mixed-use property investments

The Real Property Investment Grant is available to investors who rehabilitate, expand or construct new projects within the Enterprise Zone. The building or facility must be: commercial, which includes office and retail space; industrial; or mixed use, in which 20% of the space is devoted to commercial or industrial use.

What kind of improvements are eligible?

Qualified real property investments cover a wide range of construction costs, including: carpentry, ceilings, demolition, doors and windows, drywall, HVAC, painting, plumbing, masonry, roofing and more. These improvements must be structurally part of the building or facility, which means signage, furnishings and appliances aren’t qualified investments for the RPIG.

How grant awards are calculated:

The dollar amount awarded to recipients is based on how much is spent on Qualified Real Property Investments (QRPI).

- 20% cash grant for real property rehabilitation investments above a $100,000 threshold

- 20% cash grant for new construction investments above a $500,000 threshold

- Grant capped at $100,000 for QRPI under $5 million

- Grant capped at $200,000 for QPRI over $5 million

RPIG grant eligibility is determined based on the calendar year when the property is placed in service. This means, to be eligible for GY 2016, the property must have been placed in service between January 1, 2016 and December 31, 2016.

Who can apply?

A “Qualified Zone Investor” needs to apply for these grants:

- Property Owners Non occupant or occupant

- Multiple Owners Must coordinate grant request with all owners

- Tenant Tenants making leasehold improvements can apply for an RPIG if: they have the owner’s permission, and if the tenant capitalizes on the improvement for tax purposes

- Developers Any rights to the RPIG should be documented in sale documents if the property has been sold